Polished Diamond Prices Decline in June

Jewelers are reducing their inventory requirements as they adjust to changing consumer habits. There is a strong emphasis on bespoke services and personalized products. Consumers are also shifting to lower price points, impacting the volume and type of diamonds that jewelers need in their stores.

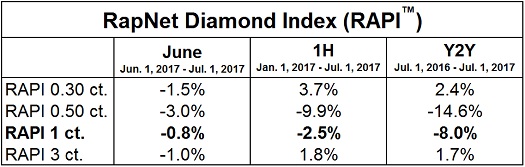

The market is selective as the trade focuses on immediate needs, with very little planning of future supply. The RapNet Diamond Index (RAPI™) for 1-carat, GIA-graded, RapSpec A3+ diamonds declined 0.8% in June and was down 2.5% in the first half of 2017.

© Copyright 2017, Rapaport USA Inc.

Polished prices fell, while rough prices continued to firm, reducing cutters’ profit margins. To support prices, De Beers is limiting rough supply, which is creating shortages in select categories of polished diamonds. Overall midstream inventory continues to rise, as old stock is difficult to move. The number of diamonds listed on RapNet rose 6.4% in June and 17.6% in the first half of the year.

Trading is expected to slow in the third quarter, a traditionally quieter period for the market. Dealers in New York, Antwerp and Ramat Gan take their summer vacations in July and August before the fourth-quarter holiday season.

The Rapaport Monthly Report – July 2017 stresses the need to boost consumer desire for diamonds in order to restore profitability. For the first time in over a decade, the industry has the funds to run an effective generic marketing program: The Diamond Producers Association has secured a $57 million budget for this year’s campaign. The hope is that stronger messaging and engagement with consumers will increase demand for diamonds, and ultimately reverse the downward price trend that continued from previous years into the first half of 2017.